Introduction to Launch Credit Union Services

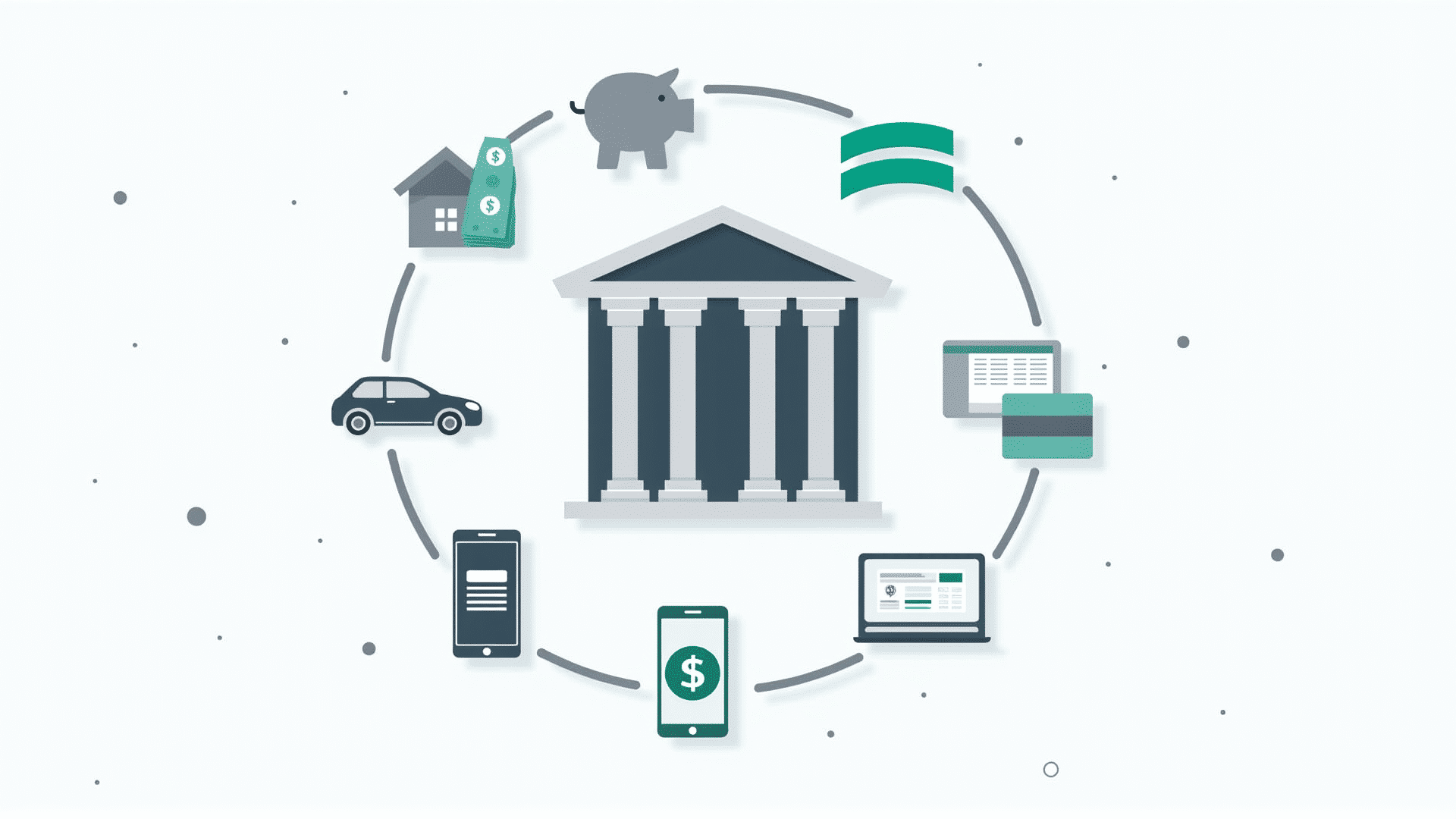

Launch Credit Union stands as a beacon of financial empowerment, offering an eclectic array of services, meticulously tailored to cater to a multitude of financial aspirations. Whether embarking on the journey to accrue savings or seeking loans that fuel one's ambitions, the credit union proffers a spectrum of solutions engineered to align seamlessly with its members' unique financial landscapes.

In the realm of savings, Launch Credit Union offers diversified accounts that range from everyday savings to more strategic investment options. These accounts are not merely repositories for funds; they are instruments designed to cultivate financial growth and stability, enabling members to fortify their financial foundations with competitive interest rates and flexible terms. Check out our digital banking options.

Should the need arise for financial augmentation, members can explore a gamut of loan products. From personal loans with accommodating terms that cater to unexpected needs or scheduled expenses, to vehicle loans that help pave the way to mobility, and mortgages that transform the dream of homeownership into reality, Launch Credit Union exhibits an unwavering commitment to support its members at every pivotal life juncture.

By transcending the conventional boundaries of financial services, Launch Credit Union not only meets the rudimentary financial needs of its members but also empowers them to navigate the complexities of financial planning with confidence and clarity. For additional peace of mind, learn about securing your account.

Digital Banking Options

In today's fast-paced world, managing finances efficiently requires more than just a traditional approach; it demands a fusion of technology and accessibility. Launch Credit Union seamlessly integrates this dual necessity with its array of digital banking options, meticulously crafted with both user-friendliness and robust security mechanisms at its core. Whether you're a tech aficionado or simply seeking convenience in your financial transactions, our digital banking ecosystem is designed to cater to your every need.

Embark on a journey through our intuitive online banking platform, where real-time account monitoring, effortless fund transfers, and customized financial insights await. With an interface that marries simplicity and sophistication, navigating your financial priorities has never been more straightforward. The online banking experience is fortified with state-of-the-art encryption and multi-factor authentication, ensuring your sensitive data is always shielded from prying eyes. Learn about securing your account to ensure your digital safety.

For those on-the-go moments, our mobile banking services offer unparalleled flexibility, allowing you to manage your financial affairs with just a few taps. Whether it's depositing checks through your smartphone camera, paying bills on the fly, or receiving instant transaction alerts, Launch Credit Union ensures that your banking capabilities remain unhindered, even when you're not tethered to a desktop.

Security remains an unwavering priority, with our digital banking services leveraging cutting-edge cryptographic technologies. From biometric logins to real-time fraud detection, rest assured that your digital experience is guarded by layers of protection.

Step into a world where your financial well-being is in your hands, thanks to Launch Credit Union's digital banking portfolio—a harmonious blend of innovation, convenience, and security. Explore further to uncover the full spectrum of features and benefits designed to facilitate an effortless banking experience.

Savings and Loan Services

When delving into the financial products offered by Launch Credit Union, one discovers an array of options designed to cater to a diverse clientele seeking to cultivate fiscal prudence or secure funding for various ventures. At the heart of their offerings lie robust savings accounts tailored to both individual and family needs, providing a stable foundation for accumulating capital over time. These accounts not only offer competitive interest rates but also prioritize accessibility and convenience, ensuring that members can manage their funds with minimal hassle. Check out our digital banking options.

Moreover, Launch Credit Union extends its suite of services to include an assortment of loan options, meticulously crafted to address different financial exigencies. Whether aspiring to purchase a new home, consolidate debt, or finance education pursuits, potential borrowers are met with flexible terms and personalized service. This approach underscores the institution's commitment to fostering a supportive and understanding environment, aiming to guide members through the intricacies of the borrowing process with clarity and confidence. Learn about securing your account.

The synergy between savings and loans at Launch Credit Union is emblematic of their philosophy to nurture financial well-being, offering not merely products, but thoughtful solutions that empower members to achieve their economic aspirations.

Account Security

At Launch Credit Union, your financial well-being is our paramount concern, and we employ a multifaceted approach to safeguard your accounts. Our commitment to state-of-the-art security includes the implementation of cutting-edge encryption technologies to shield your sensitive information from cyber threats. Moreover, our fraud protection systems are designed to detect and thwart unauthorized transactions through real-time monitoring and anomaly detection algorithms.

We understand that robust security goes beyond mere technological solutions, which is why we also encourage best practices among our members. This includes utilizing strong, unique passwords and enabling two-factor authentication. Learn about securing your account. Educating our members about the nuances of phishing schemes and identity theft is an integral aspect of our strategy, ensuring you can recognize potential threats before they escalate.

Furthermore, we adhere to industry regulations and uphold stringent compliance standards to offer you an additional layer of trust and assurance. Continuous system updates and comprehensive audits are conducted regularly to maintain the highest echelon of security.

Check out our digital banking options. By fostering a collaborative partnership between our advanced technical safeguards and your vigilance, we aspire to create a fortress of security around your financial assets. Rest assured, with Launch Credit Union, your peace of mind is non-negotiable.

Conclusion

In the grand tapestry of financial institutions, Launch Credit Union emerges as a paragon of community-oriented service, delivering an array of benefits that seamlessly intertwine with the needs of its members. Anchored by a commitment to fostering financial well-being, the credit union offers a veritable cornucopia of services meticulously curated to assist individuals in navigating the convoluted waters of personal finance.

Embedded in its mission is an unwavering dedication to member-centric ethos, where each service is designed not merely to meet but to anticipate the evolving financial contours of its clientele. From competitive loan products to innovative savings solutions, Launch Credit Union embodies a symbiotic relationship with its members, ensuring that each touchpoint enhances their financial ecosystem.

Moreover, the comprehensive suite of services is underpinned by an ethos of accessibility and innovation. Members are not just passive recipients but active participants in a financial journey crafted just for them, with digital banking platforms offering ease and convenience, while personalized financial counseling provides strategic guidance. Learn about securing your account as part of these innovative services.

Thus, as Launch Credit Union continues to illuminate the path to financial inclusivity and empowerment, its pledge to deliver unparalleled member services remains resolute. This commitment, invariably, propels its members towards prosperity, underscoring the credit union’s pivotal role as not just a financial institution, but as a transformative partner in the quest for financial success.